Most pharmacy professionals will tell you that drug prices are astronomical. That’s more than just an opinion.

Drug prices in the United States (even among generics) are some of the highest in the world. US drug prices are 250% higher compared to 32 other countries, and prices for half the drugs covered by Medicare in 2020 rose faster than inflation.

The purchasing ecosystem further complicates pharmacies’ work. Those high drug prices are listed across multiple wholesalers and vendors. And they all use separate catalogs and purchasing interfaces. In some cases, the same product might appear under multiple classes.

Pharmacy teams are left searching through this morass of data. Even if they can find the true best price, it means losing hours of time that could be spent with patients. It’s also a tedious process that leaves staff feeling burned-out.

Steep drug prices combined with an opaque purchasing ecosystem mean pharmacies are losing money and time while increasing their stress. But SureCost discovered how smarter purchasing provides a crucial advantage. We recently published our Smarter Purchasing Report, and this article will walk you through what we discovered.

Method and Findings

We analyzed purchasing data from our entire customer portfolio: pharmacies managed by over 5,000 pharmacy professionals across the country. Data were anonymized and standardized to ensure an accurate, objective “apples-to-apples” comparison. Client interviews provided additional context and insights.

Based on that analysis, we isolated five key areas where pharmacies can drive savings:

- Product savings

- Accurate value of received goods

- Vendor non-compliance

- Cost of reordering

- Vendor substitution

We’ll discuss each area in this article, preview key data and offer strategies to implement smarter purchasing at your pharmacy.

1. Product Savings

Brand names versus generics, multiple vendors (including primary, secondary and even tertiary), multiple equivalents for the same item and different interfaces for each vendor: it’s no wonder that finding the best prices for products has become a time-consuming and frustrating process. Even if you have the time and staff to sift through all that data, there’s still no guarantee you’ve found the best purchasing option.

To narrow the search and find better prices, many pharmacies shop the top 200 generics: the generic prescription drugs most commonly purchased and dispensed on the market. Yet SureCost discovered that its customers save even more when they shop beyond the top 200. In fact, 65.5% of SureCost users’ savings came from outside that group.

.png?width=1641&name=Savings%20on%20COG%20pie%20(1).png)

SureCost gives these pharmacies visibility into purchasing options without the need to compare all the data themselves. They don’t just save money and time. They also ensure compliance with primary vendors, manage all their orders from one place and reduce time spent poring over data and placing orders through different websites.

What could access to all of your purchasing options do for your pharmacy?

For all of the insights, with all of the comprehensive data and quotes from pharmacists, download The Smarter Purchasing Report.

2. Accurate Value of Goods Received

When you pay invoices, are you sure you’re only paying for what you actually received? Are you always getting the right amount of what you ordered? Has an NDC or cost changed between when you placed an order and the vendor invoiced you?

For many pharmacies, costly discrepancies like these are hiding within the data. That means you could be paying more than you should without even getting the products you need!

Among SureCost users, 0.18% of invoices were higher than the actual amount of goods received. That may sound like a small number, but for a pharmacy with an average annual purchasing volume of $3M, it means $5,400 in yearly losses.

What would 0.18 of your purchasing volume be for your pharmacy? Are you satisfied with losing that amount each year?

You can avoid these expensive mistakes. Find software that provides Accounts Payable Reconciliation. That way, you’ll always:

- Verify invoices against orders at the time of receipt

- Compare what’s ordered, received and invoiced

- Have a single interface to unify all steps in the process

Accounts Payable reconciliation also allows you to track these inaccuracies and guard against losses, ensuring accountability as well as efficiency.

3. Vendor Non-Compliance

Unfortunately, vendors sometimes accidentally charge more than their quoted contract price. Obviously, this can cost the pharmacy more than they should be paying. But it also leaves them stuck monitoring every purchase, using up more of their precious time and piling on the tedium and frustration.

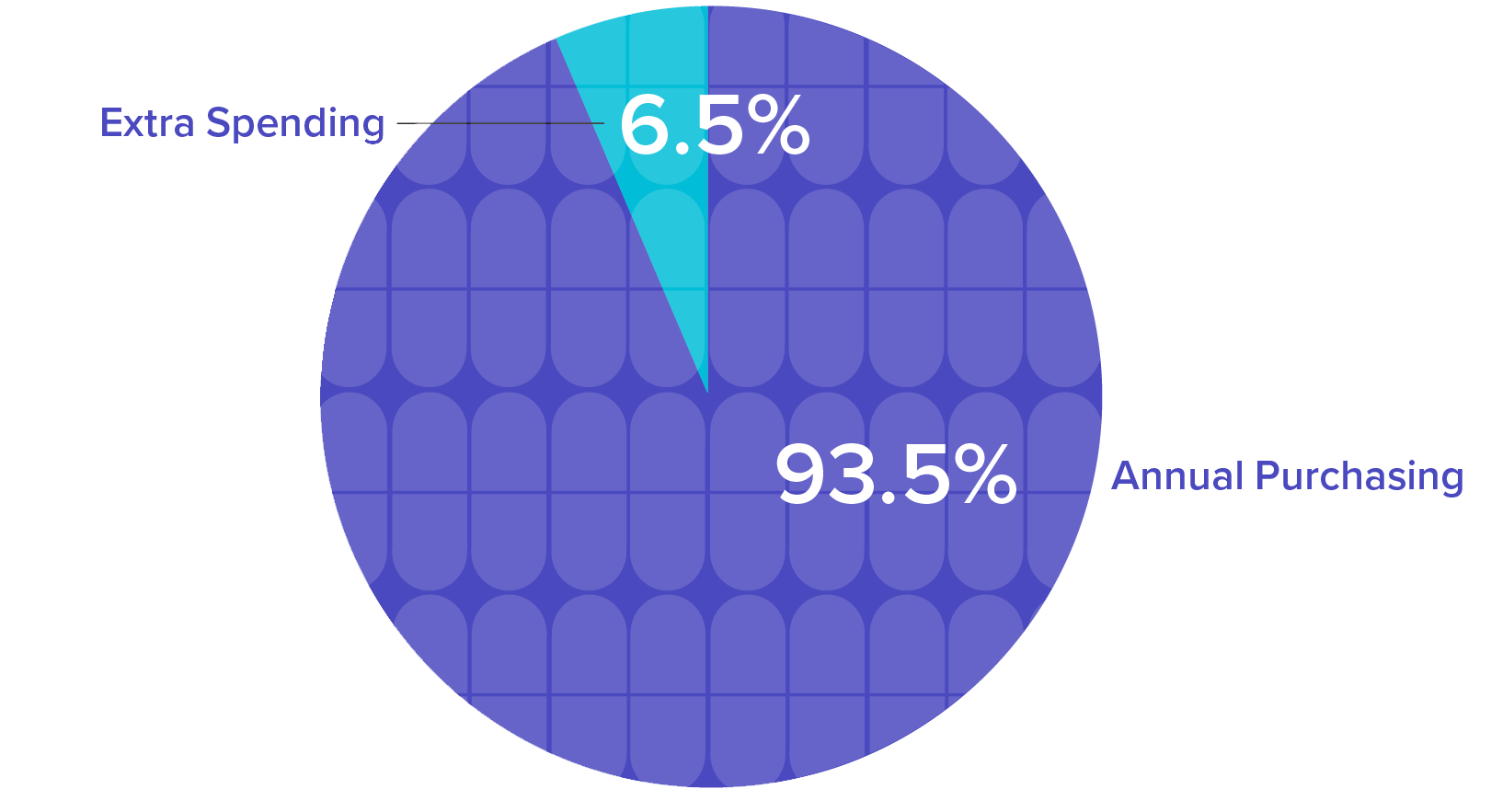

SureCost’s analysis revealed vendors’ non-compliance resulted in a 0.16% increase in charges—about $4,800 in wasted expenses every year for a pharmacy with a purchasing volume of $3M. In addition, 6.5% of all items tied to purchasing contracts were at a higher cost.

If you knew that 6.5% of your pharmacy’s spend was due to paying more than you should, what could you do about it? For starters, find a solution that immediately flags when a vendor doesn't honor the quoted contract price. That way, you can monitor compliance and immediately address the issue with your vendor.

Leverage transparency into your relationships and transactions. You'll always receive and pay for what you agreed to. With an eye on all aspects of procurement, you’ll also gain peace of mind.

4. & 5. The Cost of Reordering and Impact of Vendor Substitutions

In The Smarter Purchasing Report, we also cover the cost of reordering. Out-of-stock items are nothing new. But supply chain issues and other global issues have only exacerbated them. Now more than ever, out-of-stocks leave pharmacies scrambling to replenish, shopping at the last minute and paying more.

The later you discover an out-of-stock, the worse these issues get. Even a small percentage of reorders can have detrimental effects. It’s hard to quantify the stress of a last-minute rush to get patients what they need. But what would these statistics look like in terms of disappointed patients and lost sales at your pharmacy?

In addition to mistakenly sending pharmacies an incorrect item, vendors may substitute a product before shipping it—without informing the pharmacy—and pharmacies don’t always see the substitution. Not only do the pharmacy and the patient receive something different than they expected, but pharmacies might end up paying more without even noticing it.

Once again, pharmacies are not getting what they paid for and might not even know about it. How often does it happen, and how much does it cost?

To find out the answers to these questions, download The Smarter Purchasing Report today.

Put simply, you need awareness of your purchases at every stage. That means the ability to track products, monitor substitutions and flag changes so you can settle the issue with the vendor as soon as you get that substituted product.

Conclusion

SureCost learned a lot from this analysis, and we hope you did too. As you can see, smarter purchasing can make a huge difference in saving money and time and also reducing headaches!

For a deep dive into each of these strategies and the bigger picture, download SureCost’s Smarter Purchasing Report.

.png)